Last year, NFTs took the world by storm. Trading volume of NFTs topped $13 billion in 2021 — an enormous 43,000% increase compared to year before. We saw a dizzying pace of adoption from consumers, creators, brands, and even governments.

Like many other NFT enthusiasts, I was captivated by NFTs almost immediately. Trading and collecting NFTs quickly became a passion of mine. As my personal collection grew, so did my online connections and communities in the space. For me, there had never been a more exciting time to play on the internet.

Fast forward to May 2022. The equity and cryptocurrency markets are in a record free fall, and it seems that we have entered a bear market for NFTs as well. NFT.NYC is less than a month away, but the chaos of the market has everyone wondering — will the summer of 2022 be the beginning of a long NFT winter?

Making sense of the data

There have been a lot of dramatic statistics and headlines about the NFT market circulating over the past few weeks. I was curious what was really happening under the surface, so decided to dig into a few key metrics.

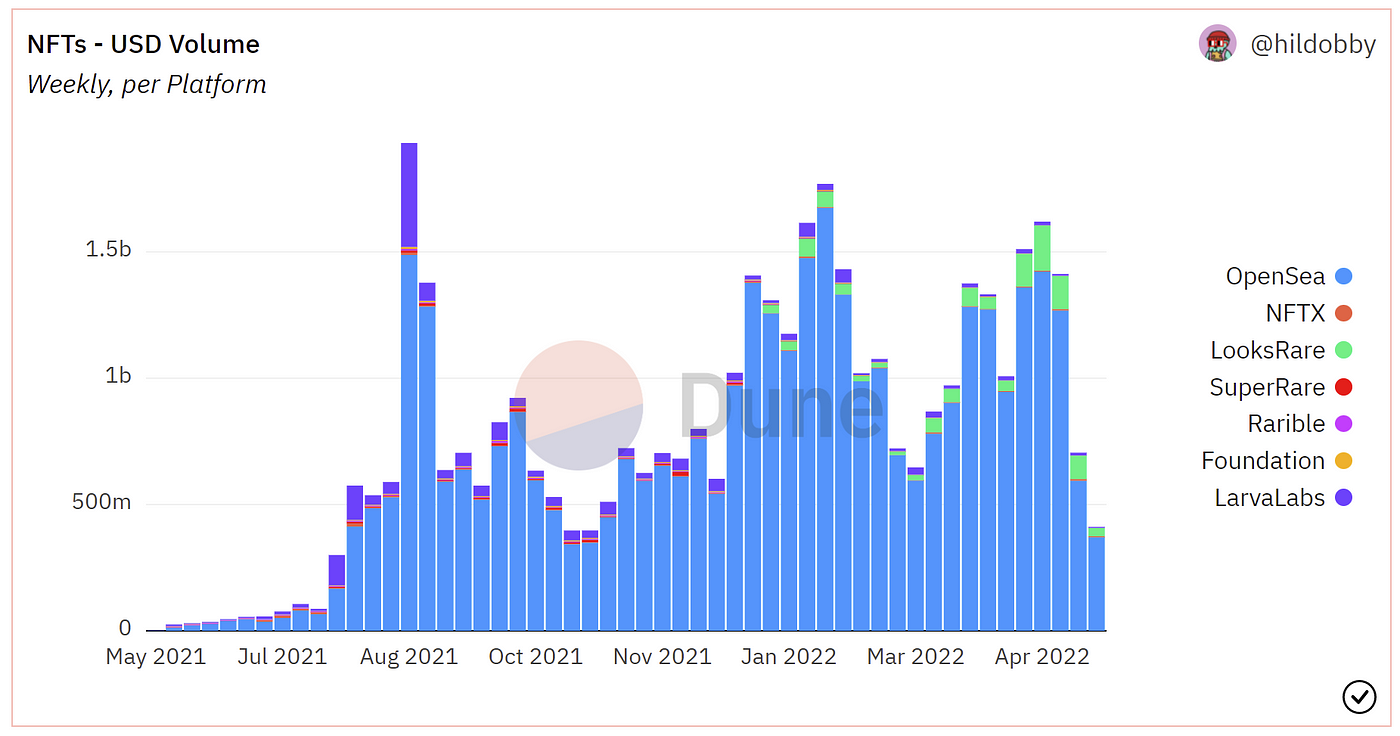

The first and most obvious metric to look at in order to understand the state of the NFT market is trading volume. To set some context, NFT trading volumes have always been highly volatile, especially on a week by week basis. Volume spikes can be driven by just a few individual projects (e.g., Otherside, Moonbirds) with enormous volume.

With that in mind, let’s look at recent NFT trading volume across platforms.

Clearly, the volume over the past couple of weeks is down from all-time highs. However, trading volumes in May are not far off from where they were in Q4 2021, which was considered a very strong quarter for the NFT market. In other words, the dip we are seeing now is not too dissimilar to the normal volume fluctuations we have seen over the past year (so far).

Furthermore, NFT trading volume in 2022 YTD has already exceeded total trading volume in 2021, which means that no matter what happens, 2022 will be another big year for NFTs.

Another important data set to look at is user activity and growth.

The data shows that the number of active NFT traders continues to grow at a steady pace. There are now over 1.7M registered users who have made at least one transaction on OpenSea, which means that OpenSea’s user base has nearly doubled since the beginning of the year (there were only~900K traders back then).

The number of weekly active NFT buyers and sellers has also remained relatively steady and is still higher than 2021 levels.

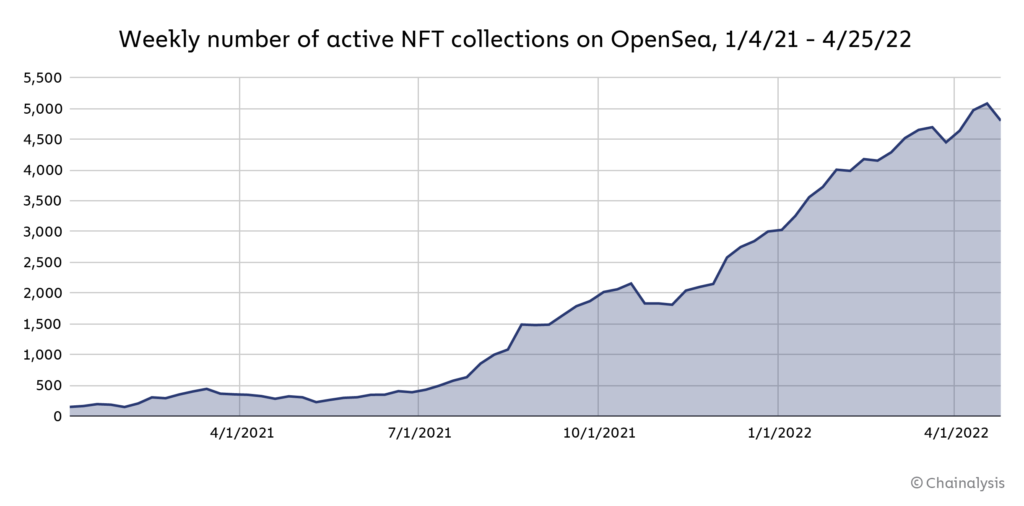

On the creator side, the number of active NFT collections continues to climb, which suggests that existing NFT creators continue to release new collections and/or that new NFT creators are still entering the space.

The last metric I will highlight is NFT floor price. For those who are unfamiliar, floor price refers to the lowest price for an item in an NFT collection.

During previous NFT bull runs, there has been an inverse relationship between the price of Ethereum (in USD) and the floor price of NFTs (in ETH). In other words, when ETH price went down, NFT prices would go up (in order to maintain their USD value).

In this current market, we have not seen this inverse relationship hold. Recent NFT collections, even those at the very top of the quality and hype scale, have struggled to maintain their floor prices (for example, CPG Pop, a very reputable and popular project, is currently trading well below mint price).

That being said, blue chip NFTs are continuing to hold their value for the most part. Collections like BAYC, CryptoPunks, and Doodles may be down 40–50% from all-time highs, but are still trading at or above 2021 floor prices.

So what does all of this data tell us about the state of the NFT market? No one knows what will happen over the next few months, but here is my interpretation of the data to date:

- NFTs are a large market: Total NFT sales will be higher in 2022 than 2021, which means that the NFT market will see year over year growth as well as two consecutive years of multi-billion dollar NFT sales.

- Demand has not fallen off a cliff: Transaction volumes cooled from all-time highs, but have not fallen off completely and are (so far) staying in line with last year’s volumes.

- User adoption has persisted: The number of users transacting has remained relatively stable, and the number of total buyers and sellers continues to grow (even if at a slower rate than before).

- Individual NFTs still hold significant value, even in a bear market: Blue chip NFT prices have come down from all-time highs, but continue to trade at prices in the hundreds of thousands of dollars.

Creator sentiment and outlook

In addition to examining NFT market data, I wanted to hear how NFT creators and builders are feeling about the market and how recent events may have impacted their plans and strategies. I asked some incredibly talented folks in the space to share their thoughts. Here are the insights I gathered from those conversations:

1. Serious builders are not leaving the space, but speculators are. This correction will be net positive for the market and for the community.

“This downturn will push out people who were in it for the wrong reasons. I am personally excited more every day. This market lets us build without hype, which all builders love.”

— Alex Taub, Co-founder of Illuminati NFT

2. For serious builders, the current climate does not significantly impact their long-term roadmaps and visions.

“I don’t think [the market] changes anything about the high-level direction of the project because we’ve always been thinking much more about fundamental (over speculative) value.”

— Xuannu, Co-founder of Crypto Coven“The state of market doesn’t change how we’re building because NFTs support the grander vision we have as a media company. It’s less about the secondary price of NFTs and more about connecting artists and fans.”

— Ryan Caradonna, Co-founder of EQ Music

3. Even if their long-term goals haven’t changed, NFT creators are being thoughtful about what resonates most with consumers given the current climate.

“The current state of the market has definitely affected our launch strategy. We’re currently rethinking the launch plan and are now targeting a more limited release with a smaller collection.”

— Mina Salib, Co-founder of Little Miner NFT“I think free mints (as user acquisition) and membership NFTs with underlying access to something will do well during a down market.”

— Alex Taub, Co-founder of Illuminati NFT

4. A softer market will raise the bar on NFT projects, which should improve the overall quality of new launches going forward.

“The NFTs that launch over the next 6 months will increasingly be of higher quality teams building something real.”

— Elliot Koss, Founder of Future NFT Mints“I’d expect to see a lot more rigor as the current wave of projects starts to see longer-term outcomes and people begin to get much more discerning about buzz vs. fundamentals.”

— Xuannu, Co-founder of Crypto Coven

5. NFTs will need to evolve beyond just collectibles/art to withstand market cycles. NFTs will maintain value by enabling new use cases and business models.

“People need to think beyond NFTs themselves as collectibles and more how can to leverage NFT capabilities to build new business models. Projects that see NFTs as a tool to deliver shared ownership and economics will win.”

— Ryan Caradonna, Co-founder of EQ Music

6. NFTs will continue to play a critical role in the web3 ecosystem, regardless of whether we are in a bull or bear market.

“My vision of the future is one where NFTs have managed to redefine most of our daily activities and experiences.”

— Ben, Founder of Mendel NFT“I see NFTs continuing to be the way a large amount of folks are introduced to blockchain and web3 in general. As a fundamental building-block technology, they will probably have relevance as long as web3 does.”

— Nyx, Co-founder of Crypto Coven

What will the future hold?

What’s clear from both the data and the creator commentary is that like the broader crypto and web3 space, the NFT space has gone through cycles of speculation and likely overinflation. We are clearly seeing a market correction now, but that in itself is not necessarily cause for panic. Despite the negative market conditions, consumers continue to buy and sell NFTs at a significant rate and NFT creators are continuing to build meaningful projects in the space.

I personally have a lot of conviction that NFTs are here to stay and that NFTs overall (the technology, the use cases, etc.) will continue to evolve rapidly during this market cycle.

In the face of a challenging macro environment in the near-term, builders will need to be incredibly focused on delivering real value to their communities. There are a number of areas where I think there is a very large opportunity to build, including:

- Products that help NFT creators manage and strengthen their existing communities (Co:Create, Highlight, Portal, etc.)

- Products that help brands build deeper relationships with and experiences for their customers via crypto-powered commerce (e.g., PERCS**)

- Products that are creating new utility for NFTs, such as tokenizing physical assets (Courtyard, RareMint, 4K, IYK, One of None, etc.)

- Products that enable consumers to access financial benefits (e.g., liquidity) with their NFTs (Vera, Arcade, PWN, etc.)

So are we headed for a long NFT winter? It’s too early to say — market conditions are certainly scary, driving many people to pull out of NFTs and crypto in general. However, the data shows that the NFT market is still strong — especially compared to where it was a mere one year ago. A dip now doesn’t mean that the NFT market is done for.

On the contrary, as with other markets, a downturn will force a survival of the fittest in the NFT world. The builders who are doubling down right now will define the future of the NFT ecosystem, and what emerges from this time will likely be the best and strongest NFT projects and companies we have seen. Here’s to hoping for that — and to holding on for dear life in the meantime!

Thank you to the NFT creators and builders quoted in this article. I am constantly inspired by you and am honored to be a member of your communities!

If you are building in the NFT space or want to connect about this topic, please feel free to reach out to me on Twitter (@lisamxu) or by email (lisa@firstmarkcap.com).

*NFT stands for non-fungible token. For an overview of NFTs, you can check out this beginner’s guide.

**FirstMark is an investor in PERCS.